Getting into debt is never usually a good idea. It is tempting, no doubt. The thought of having all a bit of extra cash for a holiday or new car can come in handy for anyone. But, unless you can guarantee to yourself that you can afford to take out the debt, and then you could end up in financial trouble. You could end up paying a lot more back than you borrowed, and the consequences of defaulting could be far-reaching. So, what can you do? Here are five ways of getting rid of your debts that might work for you.

1: Do it yourself

Have you heard of debt consolidation? In most cases, we would say not to bother with it. Consolidating your debts is just handing them over to somebody else. They will contact your creditors and make a deal with them that you will pay x amount per month. Then they will add a nice little surcharge on top for their Christmas bonus. It’s that simple – and there is no reason that, if you have the time, you can’t do it yourself.

All you need to do is make a list of all your debts and identify the areas you need to tackle first. Always pay off the most expensive debts as soon as possible, as this will lead to a snowball effect. If you keep paying the same amount each month and it won’t be long before you have made serious headway. And also, make sure you change your financial lifestyle to make sure it doesn’t happen again.

2: Communicate

Many people, once they get into debt, tend to put their heads in the sand. This is a perfect example of the wrong approach to take. Whenever you hit the skids, and debt has become overwhelming, you should get in touch with your creditors right away. They won’t want you to be in trouble – not for any concern about your welfare, but because they want their money back. Because of this, they will tend to bend over backwards for you in the early days.

The longer your debt remains unaddressed, the worse your creditors are likely to take it. Although being taken to court over a few thousand pounds is a rare occurrence, it does happen. And, whether you are afraid of legal threats or not, your credit report will be affected. However, if you struggle with communication, then you should think about approaching a credit counseling service. Services like StepChange.org can contact your creditors and help you come to an arrangement on your behalf. Credit counsellors are especially useful if your debts are out of control, but you do need to be careful.

3: Get a loan

Now, this might be a bit controversial because you shouldn’t use a loan to pay off another loan. But, depending on the size of your debt, you could benefit by getting a loan – as long as you can meet the terms under which it was set.

The key to success is to find a lender with clear and legible terms and conditions, like Cash Float. It is crucial to know what you are getting into, so avoid getting a loan if you are confused. Primarily, you need to work out if the loan is better value for you than your debt. If you can get a better interest rate, this is usually a good sign. However, you should also take into consideration the length of the loan.

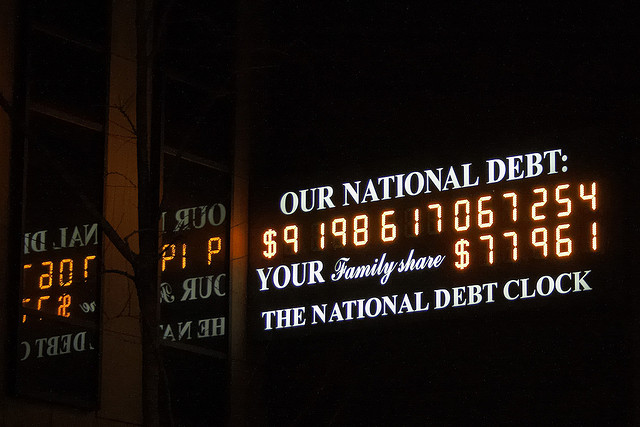

Credit: Jason Kuffer

Look for a new credit card

One of the easiest ways to give yourself a breather is by switching your credit card. Let’s say you have been hamstrung by a rise in interest rates and are struggling to make the payments each month. Switching to a new credit card with an introductory interest offer will wipe off that interest in an instant.

Lenders will charge you a fee for a balance transfer, but this is often small in comparison to what you would save in interest payments. Switching cards is also very hard to do if you have severe credit problems – although not impossible. The key to making a switch work is to keep paying the same amount. The more you pay off in that introductory period, the better off you will be in the long term.

4: Go on a DMP

Your credit counselor may advise that you go with a debt management plan or DMP. DMPs are when you make an agreement with your creditors that you will pay them back over time at a set rate per month. It is possible to do this with your creditors yourself, or you could get your counseling agency to do it for you. There are two important things to remember about DMPs.

Firstly, they are no more than a ‘gentleman’s agreement’, whether you have called in a counseling service to help or not. They are designed as a way to diffuse the problems between debtor and creditor but have no legal basis. Secondly, your lender could change the terms at any time, regardless of what the original agreement says. Usually, they won’t – assuming you pay them back the right amount each month. However, if your financial situation improves, they have the right to change those terms. Also, it will be shown on your credit report until you have paid it all off.

5: IVA or bankruptcy

An IVA, or Individual Voluntary Arrangement, is a more formal agreement than a DMP. You pay a set amount each month and at the end of a six-year period, the rest of the debt is written off. This gives creditors some money back on their original loan and gives you some breathing space. Once an IVA is in place, they cannot hassle you for money all the time.

Bankruptcy is the most drastic choice of all, and should not be undertaken lightly because it can have serious implications for the rest of your life. While it will write off the vast majority of your debts, you should bear in mind the consequences. Anyone that goes bankrupt will be virtually stripped of anything that they own that is not essential to their life. That could include your car, television, or any other asset that will give your creditors back some money. The current cost of bankruptcy is around £700, including court fees.

We hope this article has helped. Don’t forget, that if you have any serious financial issues, you should always speak to a professional for help.